This session has been an interesting one. We have been able to kill a few really bad bills and still attempting to get some positive legislation passed

and onto the Governor’s desk. This list is only the transportation related bills but if you go to the ABATE of Arizona website under Legislative/Legislative Update you can find the entire list of relevant bills you may be interested in.

BILLS STILL IN PROCESSSB1312 Vehicle mileage; tracking; tax; prohibitions

This state, counties, municipalities, and political

subdivisions are prohibited from establishing vehicle miles of travel reduction goals or targets in

developing any transportation or land use planning

or selecting transportation or transit projects. This

state, counties, municipalities, and political subdivisions are prohibited from tracking or maintaining a

record of a person's vehicle miles of travel. This state, counties, municipalities, and political subdivisions are prohibited from imposing or collecting any

mileage fee or tax, a per-mile charge, fee or tax or any

tax or fee based on vehicle miles traveled by an individual in a motor vehicle.

SCR1018 Prohibit tax; monitoring; vehicle mileage.The 2024 general election ballot is to carry the question of whether to amend the state Constitution to prohibit the

state, counties, municipalities, or other political subdivisions from imposing a tax or fee on any person based on vehicle miles traveled or imposing any rule or law to monitor or limit the vehicle miles traveled of a person in a motor vehicle.

HB2063 Appropriation; State Routes; 238; 347Makes a supplemental appropriation of $13 million from

the State Highway Fund in FY2022-23 to the Department

of Transportation to distribute to the City of Maricopa to

design and construct improvements to State Route 238

and/or State Route 347. Reduces the FY2022-23 appropriation from the State Highway Fund to the Department

of Transportation for the design to widen lanes along

State Route 347 between Interstate 10 and the City of

Maricopa to $6 million, from $19 million.

HB2080 Emergency alert technology; vehicles; devicesBeginning January 1, 2025, all new motor vehicles and portable wireless communication devices sold in Arizona

are required to contain "emergency alert technology" (defined).

HB2288 Roundabouts; right-of-way; large vehiclesThe operator of a vehicle or combination of vehicles with a total length of a least 40 feet or a total width of at least 10 feet may deviate from the lane in which the operator is driving to the extent necessary to approach.

SB1097 Truck routes; designationFor ordinances or resolutions enacted on and after January 1, 2020, the Arizona

Department of Transportation (ADOT) or a

local authority may only restrict or prohibit a "vehicle of legal size" (defined) from operating on a highway that is a "major arterial street" (defined) and that connects two or

more local jurisdictions if ADOT or the local authority conducts a test drive or applies a vehicle template on the highway that shows that a vehicle of a legal size may not safely operate on the highway. A highway that does not have a "truck restriction" (defined) before being annexed by a local authority

cannot be incorporated into an existing truck restriction that is passed on or after January 1, 2020 unless the highway meets the criteria in this legislation. A local authority that passed an ordinance on or after January 1,

2020 that is inconsistent with these provisions is required to repeal or amend the ordinance to comply with this act within 90 days after the effective date or the ordinance is invalid. AS PASSED SENATE.

SB1234 Prohibition; photo radarState agencies and local authorities are prohibited from using a photo enforcement system to identify violators of traffic control devices and speed regulations. Statutes

authorizing and regulating photo enforcement systems are repealed. Contains a legislative intent section.

FAILED BILLSSB1122 Transportation tax; election;

Maricopa countyIf approved by the voters at a countywide

election, a county with a population of 3

million or more persons (Maricopa) is

required to levy a tax of up to ten percent

of the transaction privilege tax rate as of

January 1, 1990. The tax levied will be in

effect for 15 years. Specifies the distribution of net revenues from the tax levy,

with 80 percent of revenues distributed to

the Regional Area Road Fund for freeways and other routes in the state highway system, and 20 percent of revenues

distributed to the Regional Area Road

Fund for major arterial streets. Beginning

January 1, 2026, a regional public transportation authority is established in a

county with a population of 3 million or

more persons that approves a county

transportation excise tax.

SB1245 VLT; cities and towns; countiesCounties and municipalities are required

to use vehicle license tax monies for purposes related to transportation.

SB1697 Highways; bicycle paths; walkways; prohibitionThe Arizona Department of

Transportation (ADOT) is prohibited

from accepting federal monies to pay for

the construction, maintenance or expansion of a highway or state route if the

acceptance of the federal monies is conditioned on the design and construction of a

bicycle path or pedestrian walkway as a

component of the highway or state route.

ADOT cannot plan, design or construct

bicycle paths or pedestrian walkways that

are parallel to and separate from a high- way or state route. Applies to a highway

or state route that exists before, on or

after the effective date of this legislation.

DISCUSSION ONLYSB1393 Off-highway vehicle user feesEstablishes the Off-Highway Vehicle Law

Enforcement Safety Fund (OHVLES

Fund), to be administered by the State

Treasurer and distributed in specified percentages to each of the county sheriff's

offices. Of the user fees collected from

off-highway vehicle use indicia, 30 percent must be deposited in the OHVLES

Fund, instead of in the Arizona Highway

User Revenue Fund.

VETOED BILLSSB1535 Transportation; 2023-2024.By July 31 of each year, the Arizona

Department of Transportation (ADOT)

would have been required to report to the

Joint Legislative Budget Committee

(JLBC) on the progress in improving

motor vehicle division wait times and vehicle registration renewal by mail turnaround times. By February 1 of each

year, ADOT would have been required to

report to JLBC staff how ADOT spent

ADOT's dedicated portion of an authorized third party electronic service partner's fee retention on an information technology system in the prior fiscal year. By

August 1 of each year, ADOT would

have been required to report to the JLBC

Director ADOT's share of fees retained in

the prior fiscal year by an authorized

third party electronic service partner that

has an authorized service website for

ADOT. Monies from the State Highway

Fund would have been prohibited from

being spent on projects that reduced the

capacity for motor vehicle travel. AS

VETOED BY GOVERNOR. In her veto

message, the Governor called this a

"purely-partisan budget" and expressed

her hope that elected officials will remain

open to bipartisan solutions for Arizona.

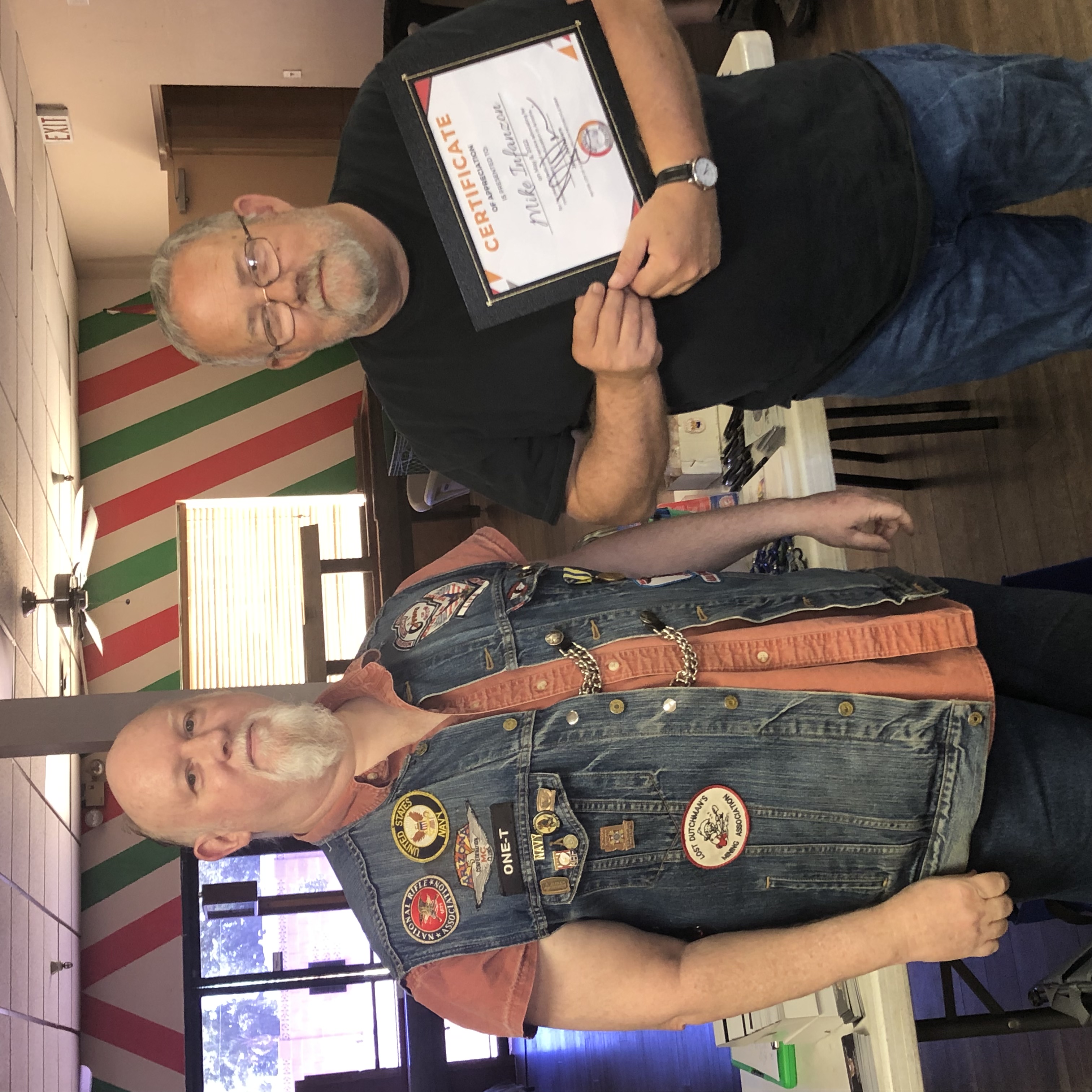

Mike InfanzonLegislative Director

This session has been an interesting one. We have been able to kill a few really bad bills and still attempting to get some positive legislation passed

and onto the Governor’s desk. This list is only the transportation related bills but if you go to the ABATE of Arizona website under Legislative/Legislative Update you can find the entire list of relevant bills you may be interested in.

This session has been an interesting one. We have been able to kill a few really bad bills and still attempting to get some positive legislation passed

and onto the Governor’s desk. This list is only the transportation related bills but if you go to the ABATE of Arizona website under Legislative/Legislative Update you can find the entire list of relevant bills you may be interested in.